Investment And Portfolio Analysis Reilly Brown Manual

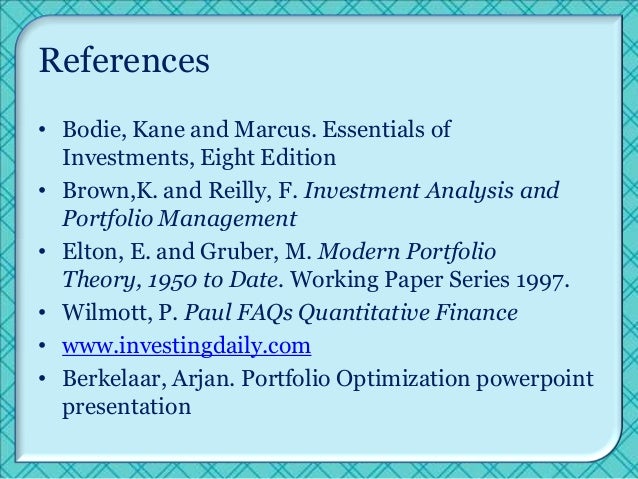

Investment Analysis and. Portfolio Management Eighth Edition by Frank K. Reilly & Keith C. Brown Chapter 1 The Investment Setting Questions to be answered. If searching for the book Investment and portfolio analysis reilly brown manual in pdf form, then you have come on to the loyal site. We presented the utter variant.

What are Chegg Study step-by-step Investment Analysis And Portfolio Management 10th Edition Solutions Manuals? Chegg Solution Manuals are written by vetted Chegg 18 experts, and rated by students - so you know you're getting high quality answers. Solutions Manuals are available for thousands of the most popular college and high school textbooks in subjects such as Math, Science (, ), Engineering (, ), and more.

Understanding Investment Analysis And Portfolio Management 10th Edition homework has never been easier than with Chegg Study. Why is Chegg Study better than downloaded Investment Analysis And Portfolio Management 10th Edition PDF solution manuals? It's easier to figure out tough problems faster using Chegg Study. Unlike static PDF Investment Analysis And Portfolio Management 10th Edition solution manuals or printed answer keys, our experts show you how to solve each problem step-by-step.

No need to wait for office hours or assignments to be graded to find out where you took a wrong turn. You can check your reasoning as you tackle a problem using our interactive solutions viewer. Plus, we regularly update and improve textbook solutions based on student ratings and feedback, so you can be sure you're getting the latest information available.

How is Chegg Study better than a printed Investment Analysis And Portfolio Management 10th Edition student solution manual from the bookstore? Our interactive player makes it easy to find solutions to Investment Analysis And Portfolio Management 10th Edition problems you're working on - just go to the chapter for your book. Hit a particularly tricky question? Bookmark it to easily review again before an exam. The best part? As a Chegg Study subscriber, you can view available interactive solutions manuals for each of your classes for one low monthly price. Why buy extra books when you can get all the homework help you need in one place?

In a ns (e ri n! T hi s )u es ti on& on e as su me s th at t he y ou n! P er so n ha s a st ea dy. ob & ad e) ua te in su ra n+ e +o ve ra!e & an d su f fi +i en t +a sh re se rv es. In di vi dua l is in th e aumulation phase of the investment life +y+le.,urin!

This phase& an individual should +onsider moderately hi!h-risk investments& su+h as +ommon sto+ks& be+ause he/she has a lon! Investment horion and mu+h earnin!s ability over time. In an s( er in! Th is )u es ti on & on e as su me s tha t th e 0 -y ea r -o ld in di vi du al has ad e) ua te insuran+e +overa!e and a +ash reserve.,ependin! On her in+ome from so+ial se+urity& she may need some +urrent in+ome from her retirement portfolio to meet livin! At the same time& she (ill need to prote+t herself a!ainst inflation.%emovin!

Money from her +ompany2s retirement plan and investin! It in money market funds and bond funds (ould satisfy the investor2s short-term and in+ome needs.

2016 ford escort service repair manual. 'ut some lon!-term investments& su+h as +ommon sto+k mutual funds& are needed to provide the investor (ith needed inflation prote+tion. T y pi +a l l y i n v e s t m e n t s t r a t e!i e s + h a n! A n i n d i vi d u a l 2 s l i f e t i m e. I n t h e aumulatin! Phase& the individual is aumulatin!

Net (orth to satisfy short-term needs 3e.!& hou se and +ar pur +has es4 and lon!-t erm!oal s 3e.!& ret ire men t and +hi ldr en5 s +olle!e needs4. In this phase& the individual is (illin! To invest in moderately hi!h-risk investments in order to a+hieve above-avera!e rates of return. In the +onsolidatin! Phase& an investor has paid off many outstandin!

Debts and typi+ally ha s ea rn in!s th at e1+ ee d e1 pe ns es. In th is ph as e& th e in ve st or is be+ om in! Mo re +on+erned (ith lon!-term needs of retirement or estate plannin!

Althou!h the investor is (illin! To aept moderate portfolio risk& he/she is not (illin! To.eopardie the 6nest e!!7 In the spendin! Phase& the typi+al investor is retired or semi-retired. This investor (ishes to prote+t the nominal value of his/her savin!s& but at the same time must make some investments for inflation prote+tion. Phase is often +on+urrent (ith the spendin! The individual believes that the portfolio (ill provide suffi+ient in+ome to meet e1penses& plus a reserve for un+ertainties.

If an investor believes there are e1+ess amounts available in the portfolio& he/she may de+ide to make 6!ifts7 to family or friends& institute +haritable trusts& or establish trusts to minimie estate ta1es. A pol i+y state ment is import ant for both the invest or and the investm ent advisor.

A po li+y sta tem ent ass ist s the inv est or in est abl ish in! Rea lis ti+ inv est men t!oal s& as (el l as providin! A ben+hmark by (hi+h a portfolio mana!er2s performan+e may be measured. S t u d e n t $ 1 e r + i s e . Th e 89 -y ear ol d un +l e an d 09 -y ea r o ld s is te r di f fe r i n te rm s of ti me h or i on. o (e ver & ea +h has so me ti me bef or e re ti re me nt 3 # ve rs us 0# ye ar s4.

$a +h sh oul d ha ve a substantial proportion of his/her portfolio invested in e)uities& (ith the 09-year old sister possibly havin! More e)uity investments in small firms or international firms 3i.e.& +an tolerate!reater portfolio risk4. These investors +ould also differ in +urrent li)uidity needs 3su+h as +hildren& edu+ation e1penses& et+.4& ta1 +on+erns& and/or other uni)ue needs or preferen+es. 'e fo re +o ns tr u+ ti n! An i nve st me nt po li +y st at em en t& t he fi nan +i al pl an ne r nee ds to + la ri fy the +lient2s investment ob.e+tives 3e.!

+apital preservation& +apital appre+iation& +urrent in+ome or total return4 and +onstraints 3e.! Li)uidity needs& time horion& ta1 fa+tors& le!al and re!ulatory +onstraints& and uni)ue needs and preferen+es4.,ata on +urrent investments& portfolio returns& and savin!s plans 3future additions to the portfolio4 are helpful& too. Return!oal 3i.e.& real!ro(th of +apital4. Ta1 minimiation (ill be a +ontinuin! +ollateral!oal.%isk Toleran+e: Aount +ir+umstan+es and the lon!-term return!oal su!!est that the portfolio +an take some(hat above avera!e risk. Franklin is a+)uainted (ith the nature of investment risk from his prior o(nership of sto+ks and bonds& he has a still lon! A+tuarial life e1pe+tan+y and is in!ood +urrent health& and his heir - the foundation& thanks to his!enerosity - is already possessed of a lar!e asset base.

: Time orion: $ven disre!ardin! Franklin2s still-lon!

A+tuarial life e1pe+tan+y& the hori on is lon!-ter m be+ause the remainder of his estate& the foundation& has a virt ually perpetual life span. i)uidity%e)uirement:?iven (hat (e kno( and the e1pe+tation of an on!oin! In+ome stream of +onsiderable sie& no li)uidity needs that (ould re)uire spe+ifi+ fundin! Appear to e1ist. Franklin is no doubt in the hi!hest ta1 bra+kets& and investment a+tions should take that fa+t into aount on a +ontinuin! Appropriate ta1-sheltered investment 3standin! On their o(n merits as investments4 should be +onsidered.

Ta1 minimiation (ill be a spe+ifi+ investment!oal. e!a l and%e!ul at or y: In ves tm en ts & if un de r th e su pe rv is io n of an in ve st me nt mana!ement firm 3i.e.& not mana!ed by Mr. Franklin himself4 (ill be!overned by state la( and the rudent erson rule. @ni)ue Cir+umstan+es: The lar!e asset total& the foundation as their ultimate re+ipient& and the!reat freedom of a+tion en.oyed in this situation 3i.e.& freedom from +onfinin! +onsiderations4 are important in this situation& if not ne+essarily uni)ue.

=3b 4.?iv en that st o+ks ha ve prov ide d 3and are e1p e+t ed to +onti nue to prov ide 4 hi!he r risk - ad.usted returns than either bonds or +ash& and +onsiderin! That the return!oal is for lon!- term& inflati on-pro te+te d!ro(t h of the +apit al base& sto+ks (ill be allot ted the ma.ority position in the portfolio. This is also +onsistent (ith Mr.

Franklin2 s absen+e of either spe+ifi+ +urrent in+ome needs 3the on!oin! +ash flo( should provide an ade)uate level for +urrent spendin!4 or spe+ifi+ li)uidity needs. It is likely that in+ome (ill aumulate to some e1tent and& if so& (ill automati+ally build a li)uid emer!en+y fund for Mr. Franklin as time passes. Sin+e the inherited (arehouse and the personal residen+e are si!nifi+ant 3'94 real estate assets already o(ned by Mr.

Franklin& no further allo+ation to this asset +lass is made. It should be noted that the (arehouse is a sour+e of +ash flo(& a diversifyin!

Investment Analysis And Portfolio Management Reilly Brown 8th Edition Solution Manual

Asset and& probably & a modest inflation hed!e. For ta1 reasons& Mr. Franklin may (ish to +onsider puttin! Some debt on this asset& freein! Additional +ash for alter native investment use.